Exploring the Future of Business: Community Banks for Sale

In the ever-evolving landscape of finance and business, the concept of local banking is making a notable comeback. With more individuals and businesses seeking personalized financial services, the phrase "community banks for sale" is becoming increasingly relevant. This article dives deep into the intricate world of community banks, highlighting the potential opportunities and the pivotal role they play in local economies.

Understanding Community Banks

Community banks are financial institutions that focus on serving the needs of a specific local area. These banks prioritize building relationships with customers, offering tailored products and services that cater to the community's unique needs. Unlike larger national banks, community banks often have a more personal touch, which can be attractive to both customers and potential investors.

The Importance of Community Banks

Community banks play a crucial role in the financial ecosystem. They are steadfast supporters of local businesses, providing essential services that larger banks might overlook. Here are some reasons why community banks matter:

- Support for Local Economies: Community banks often provide loans to small businesses and entrepreneurs, fostering job creation and local economic growth.

- Personalized Service: They offer tailored financial solutions, understanding the unique circumstances of their customers.

- Investment in the Community: Many community banks engage in philanthropic efforts, contributing to local charities and events.

- Stability: Community banks are often more resilient in economic downturns, as they focus on local lending rather than relying on global markets.

The Market for Community Banks

The market for community banks is evolving, and the phrase "community banks for sale" reflects an increasing trend among investors looking to acquire these institutions. With regulatory changes and economic challenges, many community banks are seeking buyers who are equipped to navigate the complex financial landscape.

Why Invest in Community Banks?

Investing in community banks presents unique opportunities for savvy investors. Here are compelling reasons to consider:

- Attractive Returns: Community banks can offer competitive returns compared to other investments, especially in a low-interest-rate environment.

- Market Demand: As consumers lean towards more personalized banking experiences, community banks are well-positioned to meet these demands.

- Cultural Relevance: By investing in community-oriented banks, investors can align their portfolios with their values, supporting local businesses and initiatives.

Steps to Acquiring a Community Bank

For those interested in entering the market for community banks for sale, understanding the acquisition process is paramount. Below are essential steps to consider:

1. Conduct Market Research

Understanding the local market where the community bank operates is critical. Look into the economic indicators, the bank’s customer base, and the competitive landscape.

2. Engage with Financial Consultants

Working with financial consults who specialize in bank acquisitions can provide invaluable insights. They can help assess the bank's financial health and identify potential risks.

3. Evaluate the Bank's Assets and Liabilities

Conduct thorough due diligence to understand the bank's assets, liabilities, and overall financial conditions. Look for any red flags that might indicate potential issues.

4. Secure Financing

Have a solid financing plan in place. Options might include utilizing personal funds, seeking investors, or working with financial institutions willing to fund the purchase.

5. Understand Regulatory Requirements

The banking sector is heavily regulated. It’s essential to familiarize yourself with federal and state regulations governing bank ownership and operations.

6. Develop a Business Plan

Once the bank is acquired, having a robust business plan is vital. This plan should outline strategies for growth, customer acquisition, and community engagement.

Long-Term Vision for Community Banks

As an investor or new owner of a community bank, it is essential to have a long-term vision. Community banks can thrive by aligning their operations with the evolving needs of their communities. Emphasizing technology adoption while maintaining personal relationships with customers is crucial. Here are ways to ensure growth:

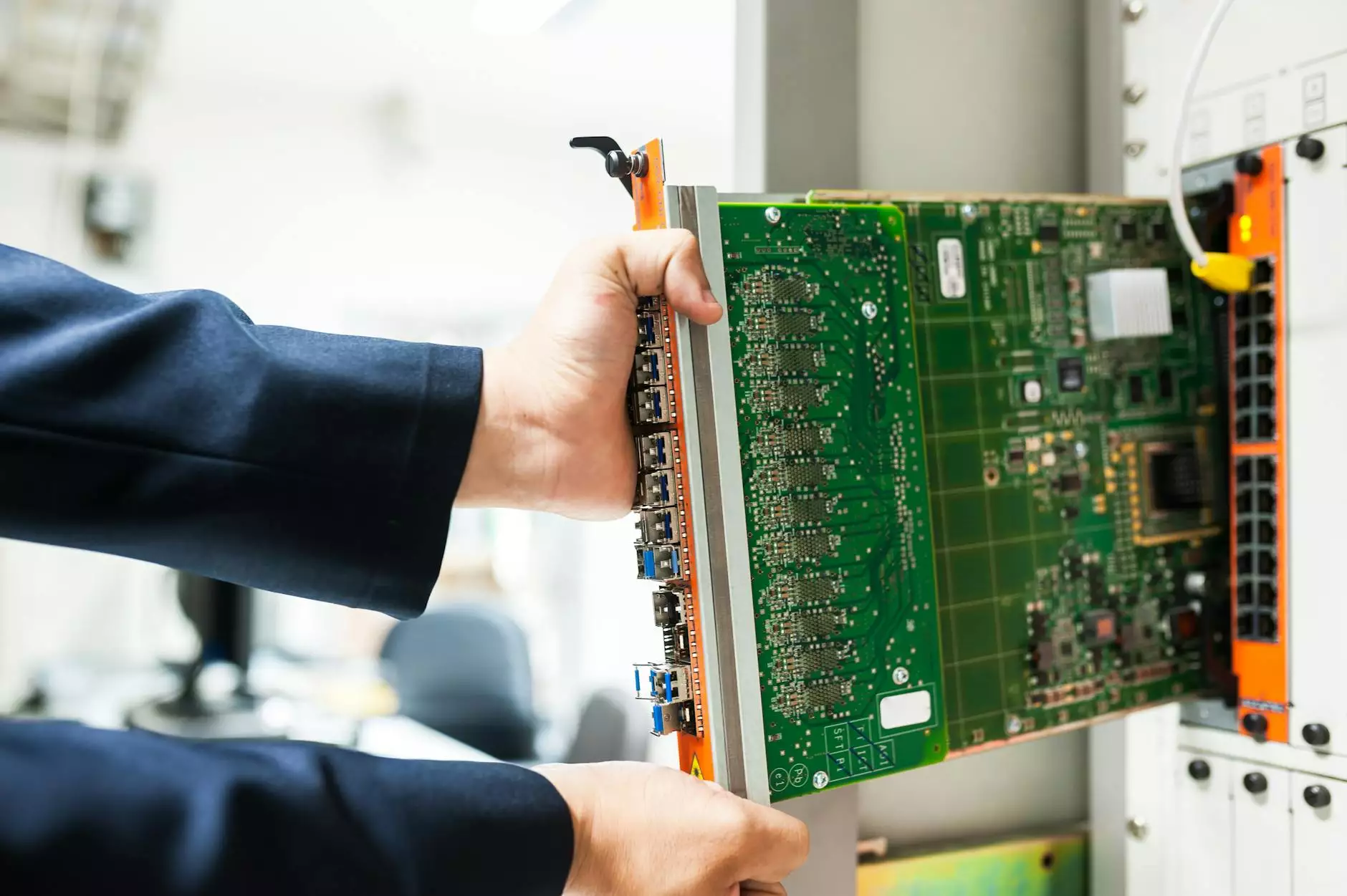

Embracing Technology

Integrating modern technology can enhance customer experience and streamline operations. Invest in robust online banking platforms, apps, and cybersecurity to protect customer data.

Community Engagement

Fostering a strong connection with the community will ensure the bank remains relevant. Use local events to promote services, offer financial literacy workshops, and engage in charitable activities.

Customized Financial Solutions

Create personalized financial solutions tailored to different customer segments. This approach effectively meets the unique needs of individuals and businesses.

Conclusion

The landscape of finance is transforming, and within this transformation lies a great opportunity encapsulated in the phrase "community banks for sale." As these banks symbolize localized support and economic resilience, the chance to invest in them not only promises potential financial returns but also contributes positively to local communities. By understanding the dynamics of community banking, potential investors can position themselves advantageously in a growing market.

For those interested in exploring community banks for sale, staying informed on industry trends and best practices will be crucial. As the demand for personalized banking experiences grows, community banks are set to play an increasingly vital role in the financial landscape.

For more insights and detailed information on banking and investment opportunities, visit eli-deal.com.